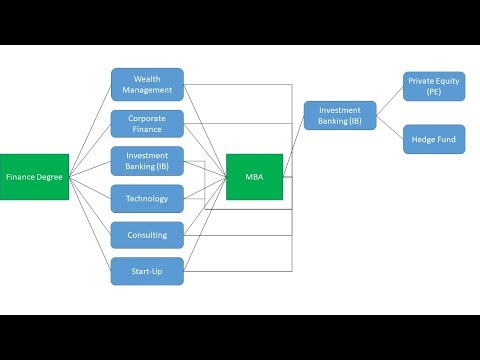

在传统金融世界(不包括量化金融),有很多职业道路可供选择。 我试图涵盖基本路径,但是您应该知道具有金融背景的人最终从事了所有不同类型的工作。 了解进入特定职业所需的条件很重要,因为某些路径需要不同的学位和经验。 这些会增加与这些路径相关的成本,在审查薪酬和工作职责时应予以考虑。 1)私募股权(通常需要投资银行经验) 2)对冲基金(通常需要投资银行经验) 3)投资银行(需要本科) 4)财富管理(需要本科) 5)企业融资(需要本科) 6)技术工作(非编码工作和本科学历) 7)咨询(本科学历) 8)业务开发/销售(本科学历) 9)如果你努力工作,你最终可能会从事更多的量化工作,例如运筹学,但通常更多需要定量课程工作或经验。 为什么我们退出投资银行业务(100,000 美元以上的薪水):私募股权薪酬:对冲基金薪酬:定量 T 恤、马克杯和连帽衫:与我联系:支持该频道:.

Images related to the topic finance career

Finance Career Paths

Search related to the topic Finance Career Paths

#Finance #Career #Paths

Finance Career Paths

finance career

你可以在這裡看到很多有用的信息: 在這裡查看更多

你可以在這裡看到很多有用的信息: 在這裡查看更多